This post was originally published on this site

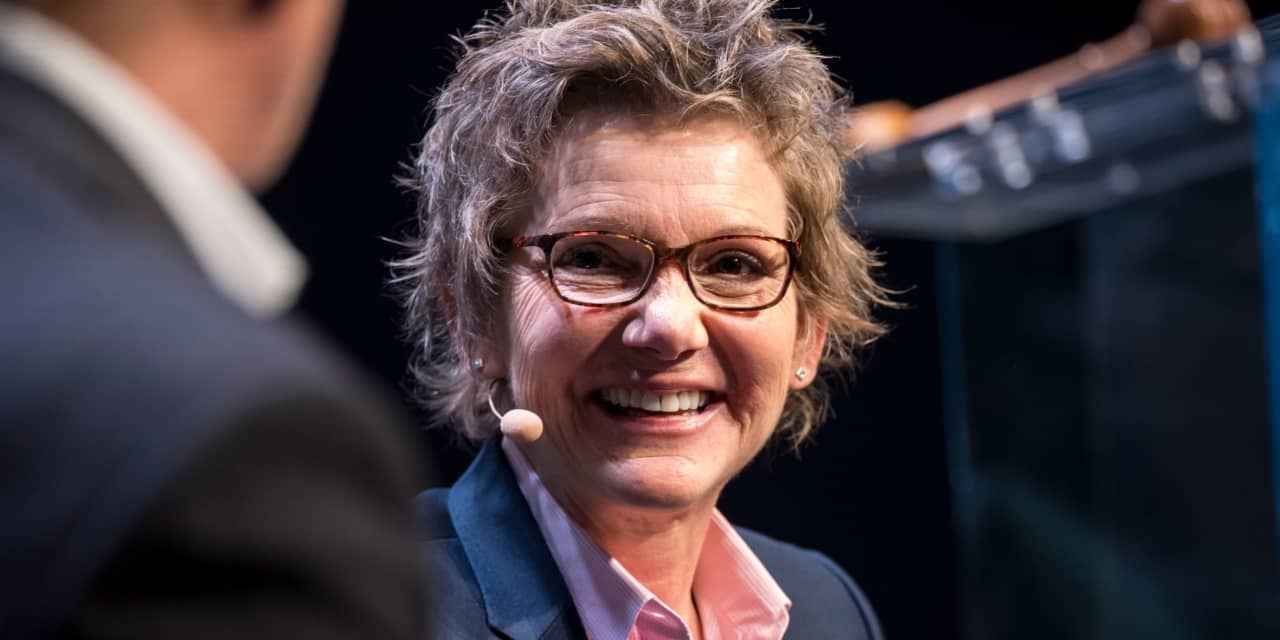

The U.S. economy doesn’t have to experience a severe recession like the late 1970s and early 1980s just because inflation has returned to 40-year highs, San Francisco Fed President Mary Daly said Wednesday.

“Now inflation is high again and many are concerned that we could soon be facing another long and painful period, followed by another long and painful correction. But that is not what I see,” Daly said in a speech to the Los Angeles World Affairs Council.

What’s different? For one thing, the Fed is, Daly said.

In the prior episode, Fed officials felt the less they said to investors and the public, the better it was for the economy.

But since then, there has been a communication “revolution” at the Fed, Daly said.

Greater transparency has led to stable inflation expectations, which remain “quite stable” even with inflation at 40-year highs, she said.

The Fed will enlist the help of households, businesses and market participants in the job of fighting inflation, Daly said, by communicating with them about the central bank’s commitment to 2% inflation and its plan to achieve it.

Inflation is also different, Daly said.

“It’s been pushed up by pandemic-related imbalances between policy-supported demand, which has remained robust, and COVID-disrupted supply, which has been slow to recover,” she said.

“Both of these factors should recede as the pandemic weakens its grip,” she said.

Stocks

DJIA,

SPX,

were down sharply on Wednesday on signs that Russia was taking even more aggressive action against Ukraine. The yield on the 10-year Treasury note

TMUBMUSD10Y,

rose to 1.984%.